Paramount Global (PARA) disclosed its fourth-quarter results on Wednesday, indicating a mixed performance. While the company acknowledged a peak in full-year streaming losses in 2022, it also noted a continued decline in linear TV revenue.

Similar to its counterparts in the media industry, Paramount has faced challenges within a difficult advertising landscape. While major tech companies have experienced rebounds in their businesses, smaller players like Paramount have struggled to do so.

In the fourth quarter, linear ad revenue saw a sharper decline than anticipated, dropping by 15% year-over-year. Analysts had expected a 12% decrease, reflecting ongoing weakness in the global advertising market exacerbated by a 5-percentage point impact from reduced political advertising. Additionally, the Hollywood strikes further impacted advertising revenue during this period.

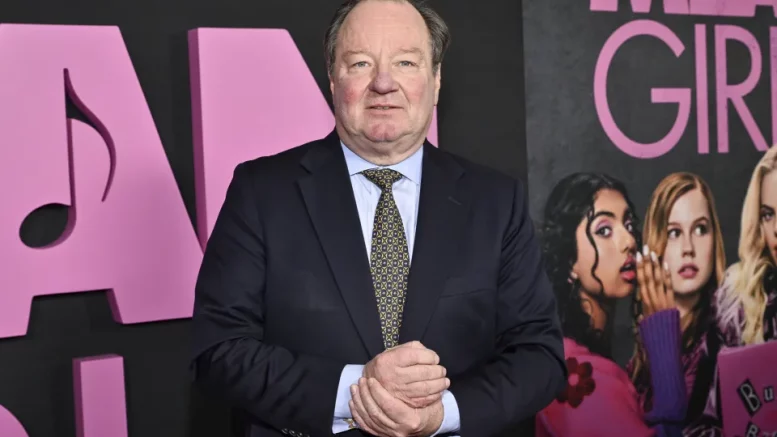

However, there was a glimmer of positivity as Paramount reported a narrower direct-to-consumer (DTC) loss of $490 million for Q4, surpassing analyst expectations. Paramount CEO Bob Bakish expressed optimism, stating that they anticipate achieving domestic profitability for Paramount+ by 2025.

Despite this optimism, the company reported full-year direct-to-consumer losses for 2023 totaling $1.66 billion, slightly lower than the $1.8 billion loss reported for 2022. Direct-to-consumer advertising revenue experienced growth, increasing by 14% year-over-year to $526 million.

Paramount emphasized its commitment to evolving its business for profitable growth in the coming years, with a focus on maximizing content investments and scaling streaming services while managing costs effectively.

Financially, Paramount posted revenue of $7.64 billion for the quarter, marking a 6% decrease year-over-year, falling short of Bloomberg consensus estimates. Adjusted earnings per share exceeded expectations, coming in at $0.04, although this represented a 50% decrease from the previous year.

Paramount+ demonstrated strength in subscriber growth, adding 4.1 million subscribers in the quarter, surpassing expectations. Subscription revenue also saw significant growth, rising by 43% to reach $1.34 billion. Overall direct-to-consumer revenue for the quarter amounted to $1.87 billion.

The company’s free cash flow improved notably due to reduced content spending following the conclusion of actors and writers strikes, surpassing expectations to reach $443 million.

In the realm of film, total revenues declined by 31% year-over-year, primarily attributed to lower licensing revenue and tough comparisons following digital releases in 2022.

Beyond financial performance, Paramount has been the subject of numerous merger and acquisition rumors. Various entities, including Byron Allen, Skydance Media, RedBird Capital, and Warner Bros. Discovery, have expressed interest in potential deals. While speculation continues, Paramount remains focused on enhancing shareholder value and implementing cost-efficiency measures to address challenges in its traditional TV business and streaming profitability.