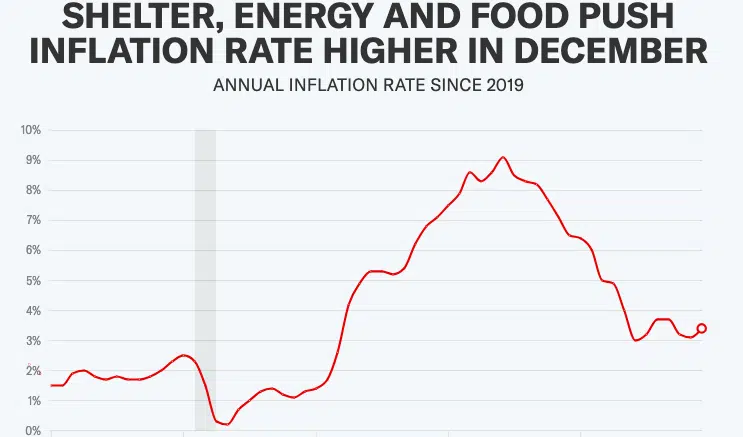

Consumer prices in the United States rose more than expected in December, according to the Consumer Price Index (CPI) data. Prices increased by 0.3% over the previous month, up from the 0.2% observed in November. On an annual basis, prices rose by 3.4%, marking an increase from the 3.1% recorded in the previous month. Economists had anticipated a 0.2% month-over-month increase and a 3.2% year-over-year rise.

When excluding the volatile food and energy categories, core inflation dropped to an annual rate of 3.9%, down from 4.0% in the previous month. On a monthly basis, core inflation remained unchanged at 0.3%. The shelter index, contributing over half of the price gains, rose by 6.2% on an annual basis. Notably, the rent prices index remained elevated, with both rent and owners’ equivalent rent rising by 0.5% on a monthly basis for the third consecutive month.

The inflation print is crucial for investors gauging the likelihood of a soft landing, where inflation retreats to 2% without an economic downturn. A soft landing could signal the end of the central bank’s interest rate hiking campaign, potentially leading to rate cuts. As of early Thursday morning, markets priced in approximately a 69% chance that the Federal Reserve would cut interest rates in March, according to the CME FedWatch Tool.

The CPI report comes as investors assess the trajectory of inflation and its potential impact on monetary policy. While markets have been aggressive in pricing in interest rate cuts, Federal Reserve officials have adopted a more measured approach. Fed Governor Michelle Bowman stated that the central bank may eventually need to cut rates if inflation falls further, but they are not yet at that point. Atlanta Fed President Raphael Bostic echoed a similar sentiment, emphasizing the importance of monitoring the economy’s evolution and hoping for inflation to reach the 2% level.